As economic conditions have changed in recent years, for B2B sales teams, efficiency has gone from an afterthought to a critical success factor. But what exactly does sales efficiency mean, and more importantly, how do you measure and improve it?

In the previous post in this series, I shared industry best practices for measuring, managing and elevating your sales performance using sales productivity as the foundational KPI.

Now we’re going to go deeper and start looking at how efficiently you’re achieving your sales output.

Just as with performance, to manage your sales organization effectively, you need accurate insight into sales efficiency across the organization, whether by region, product line, or type of business. This tells you what your sales teams are actually contributing to the business. Answering these questions can be hard but they’re some of the most important to get right.

Sales efficiency is about getting the most out of your revenue engine, ensuring that every dollar invested yields the maximum possible return.

Let’s dive in and learn more about how to measure, manage and maximize your sales efficiency.

Understanding sales efficiency

Sales efficiency is important to more than just the sales team. It matters to all business stakeholders and senior leaders across the organization. It has a big impact on profitability and the overall value of the business.

Defining sales efficiency

Let’s first define what we mean by sales efficiency. In simple terms, sales efficiency is how much revenue you generate vs. what you spent to generate it per unit of time.

Why sales efficiency is so important

1. Measures return on investment / cost efficiency

- Builds on the foundation of the sales productivity KPI we defined in the previous post in this series

- Gives you the ability to measure ROI (return on investment) as well as its inverse, cost efficiency

- The primary goal of any business investment, including in sales, is to see a return

- Sales efficiency gives you a clear picture of this return for each dollar spent, helping you understand whether your investment is paying off

2. Demonstrates capital efficiency

- Clearly demonstrates capital efficiency to stakeholders, including investors, shareholders, customers and employees

- Sales efficiency offers a transparent view of how effectively the organization utilizes its resources

- In today's market, stakeholders are increasingly focused on capital efficiency and sustainable growth

3. Operating margins

- Sales efficiency directly impacts operating margins

- By improving sales efficiency, you can improve operating margins, which is a key driver of business valuation

- This drives the overall company strategy

Sales efficiency is no longer a nice-to-have

Now, we’ve come from 2 decades of a “growth at all costs” mindset for many businesses, especially in the software and technology industries. It was more about hitting the overall sales target than it was about doing it efficiently. That has all changed in the last two years, it’s now about efficiency and profit.

Yes, we’re still responsible for hitting the number, but now we also need to be thinking about doing that efficiently. Because ultimately, that helps you improve your operating margin and drive a higher company valuation. Growth stage venture capital and private equity firms are now looking to see a path to profitability within 1-2 years before investing for example.

Measuring sales efficiency

Now that we understand exactly what sales efficiency is and why it’s important, let’s look at how to accurately measure it. We’ve included 2 advanced formulas for sales efficiency below.

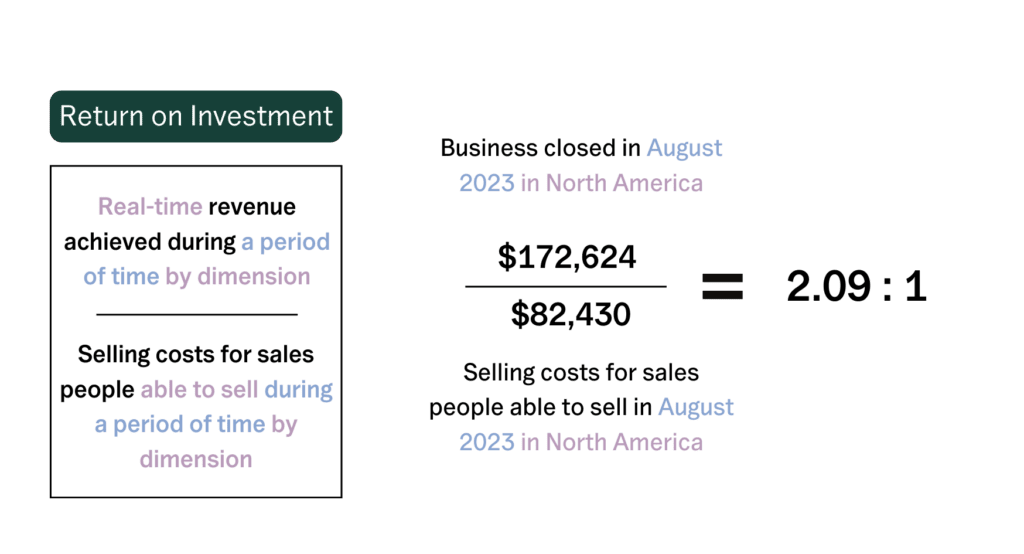

How to calculate sales return on investment: advanced formula

We’ll start with the formula for Sales Return on Investment (ROI), shown in the figure below. As with our previous advanced formula for sales productivity, we need to be granular to increase the accuracy and usefulness of this metric.

Sales return on investment formula inputs

1. Real-time revenue by dimension

- The total revenue your sales team achieved during a specific timeframe (closed won business)

- This could be per day, week, month, quarter, or even year, depending on the nature and velocity of your sales cycles

- We're not just looking at total revenue, but dissecting it by specific business dimensions - regions, market segments, types of business, product lines, or any other dimensions that may be relevant for your business

- This provides a more granular view of where and how revenue is being generated which you can use to benchmark and compare performance

2. Selling costs for salespeople able to sell by dimension

- Selling costs (see details on selling costs below) need to be for the revenue generated within the specific timeframe

- When applying selling costs, they need to be accurately applied against how many salespeople in full-time equivalent (FTE) terms were actually able to sell in each dimension during the specified period

- This should account for variances like attrition, vacation, maternity leave, transfers, hybrid roles, hire dates, ramping status and other factors, all of which can have significant impacts on sales capacity throughout the period

What costs should be included as selling costs?

A question we’re often asked is what costs should be included as selling costs when doing sales efficiency calculations. This can differ based on the type of business, stage and go-to-market strategy.

Below is a short list of costs we suggest applying depending on the business.

- Sales team variable compensation such as commissions

- Other sales performance incentives/bonuses

- Burden costs (typically applied as a percentage of compensation to allow for costs like office/overhead, IT, taxes, etc

- Marketing costs

There are other costs you could add to get even more granular, but this can add more complexity and effort to what is already a difficult KPI to accurately measure, especially for large teams or teams where the rate of change is high. We recommend keeping things simple initially so that you can get a base line of your sales efficiency, you can then build on this.

Sales return on investment formula example

Now let’s tie this back to the example in the figure above.

In North America, during August 2023, the business closed deals amounting to $172,624. The selling costs for the relevant salespeople (in FTE terms) able to sell for this period were $82,430.

This gives us a Sales ROI of 2.09x, which means that for every $1 we spent in North America in August, we got a return of $2.09.

What is a good sales return on investment multiple?

So, is the 2.09x ROI from the example a good one?

The higher your ROI multiple, the more efficiently you’re selling. A general rule of thumb for B2B sales would be to aim for a 3-5x ROI, but this all depends on the business you’re in, what stage you’re at and the strategies that you’re implementing.

Knowing your Sales ROI gives you a very important indication of when to start hiring people or when not to hire them.

For example, if you’re got an ROI goal of 3x but you’re operating at 2x, you should hold off hiring more salespeople. If you start hiring it will not just hit your sales performance (you’ll see productivity drop), you’ll also see your sales efficiency drop to a lower ROI multiple.

We see that a lot with our customers. We see productivity starting to drop and when we look at the headcount it’s going up. We then look at sales efficiency, we see the ROI dropping as well as companies tend to execute on the annual plan and continue hiring per the plan.

When ROI starts to drop, it’s not easy to fix. It can often take a couple of quarters at least to turn it around as the costs are already in the business.

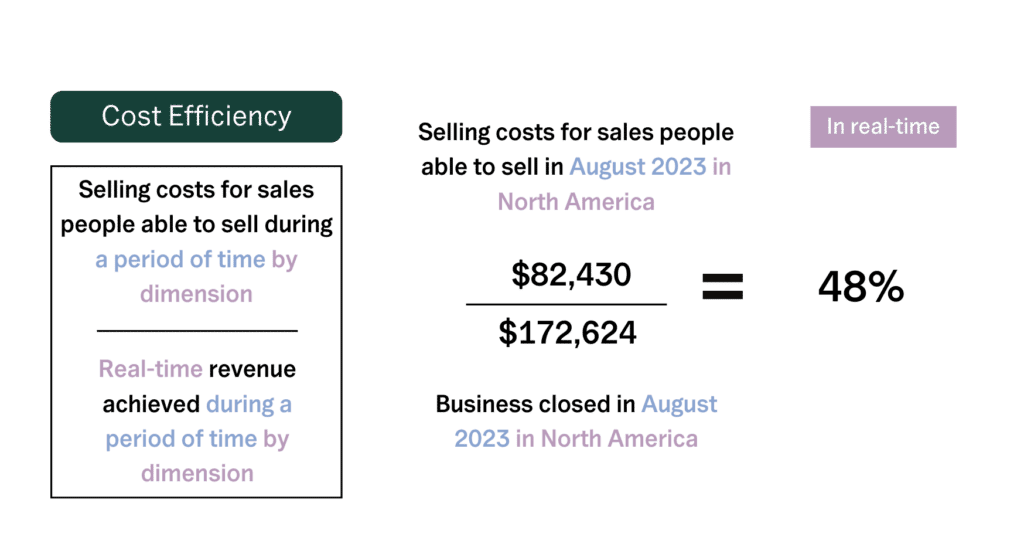

How to calculate sales cost efficiency: advanced formula

When analyzing your sales efficiency, we also suggest that you do the inverse and measure your Sales Cost Efficiency. To do this you just flip the calculation for Sales Return on Investment, as shown in the figure below.

Sales cost efficiency formula inputs

The inputs for Sales Cost Efficiency are the same as described above for Sales Return on Investment, the only difference is that the numerator and denominator are reversed.

Sales cost efficiency formula example

In the example above, you can see that in North America during August 2023, the Sales Cost Efficiency was 48%.

What is a good cost efficiency percentage?

As the inverse of ROI, the lower your cost efficiency percentage is, the more efficiently you’re selling. So, if you’re aiming for a 3x ROI, then you’re aiming for a 33% cost efficiency.

If you start to model this across the sales organization, you can create some nice graphs that show the revenue you’re generating against the cost efficiency of this revenue.

For example, you could generate bubble charts to stack rank your teams, product lines, regions or other dimensions in terms of their sales efficiency.

Insights from regular sales efficiency analysis

So now that you know how to accurately measure and track ROI and cost efficiency across business dimensions in real-time, let’s look at some of the key insights and benefits you gain that you can then apply to improve your sales efficiency.

1. Benchmark relative profitability

- You can objectively measure and compare relative sales profitability across various dimensions as it happens - whether those are territories, teams, products, types of business or even individuals

2. Accelerate investment decisions and feedback loop

- Make faster and more confident decisions on where and when to increase and/or decrease investments based on their contribution margin

- Early warning system to quickly course correct and optimize if/when investments are going wrong

3. Measure impact of compensation changes

- Assess the impact of compensation changes on sales behavior and/or profitability in real-time

- Agility to pull levers to adjust when changes don’t have the desired effect

Sales leaders make decisions that affect performance and efficiency often throughout the year. Tracking sales efficiency in real-time gives you the ability to make faster and more informed investment decisions and quickly see the impacts of those decisions so that you can course correct where needed. Doing this once a year, once a quarter or not doing it at all means that you’re making decisions with outdated information and/or without the information at all.

Top ways to improve sales efficiency

let’s take a quick look at the top ways you can use these insights to improve your overall sales efficiency and contribution to the business.

1. Invest for return on investment

- Hire people at the right times and adjust the hiring plan accordingly

- Invest in the right places and shift resources away from low/unprofitable areas

- “Strategy is the allocation of resources to the areas of best return” and that’s no different for sales teams

“We made the costly mistake of selling into SMB for 2 years when we should have just focused on Mid-Market and Enterprise.”

Kasper Hulthin, Co-founder of Peakon and Podio

2. Align compensation to goals

- Motivate the right behaviors by aligning compensation and incentives to profitability goals

3. Keep increasing productivity

- Productivity is one half of the efficiency formula, with the other being costs

- If costs don’t change, increasing the productivity of your sales team will increase your sales efficiency

Maximize the mileage of your revenue engine

At Lative, we see the shift away from “growth at all costs” and towards cost-efficient, sustainable growth as healthy and long overdue. In the future, we believe that best in class businesses will have not only have sales quota targets but will balance those against sales efficiency/sales contribution targets.

By continuously measuring and improving sales efficiency, you can maximize the mileage you get from your revenue engine, ensuring that don’t just hit sales targets but do so more profitably.

Sales efficiency is more than a metric; it’s a compass that can guide your strategy, improve your operating margins and ultimately increase the value of your business.